So, monthly amortization, mortgages, savings calculation, and education loans use simple interest. Simple interest is used in cases where the amount that is to be returned requires a short period of time. Will you invest if a bank provides a negative rate of interest?įAQs on Simple Interest What is the Use of Simple Interest?.

What if a bank provides you an interest such that your money doubles every day, if you invested $1 on day 1, in how many days you will become a billionaire?.Rate of interest is always kept in fractions in the formula.The formula or methods to calculate compound interest is derived from simple interest calculation methods.Interest is always more in the case of compound interest as compared to simple interest.The rate of interest is the interest on every $100 for a fixed time period.To find the time period, the day on which money is borrowed is not taken into account, but the day on which money has to be returned is counted.It is different for every span of the time period as it is calculated on the amount and not principal. It is equal for every year on a certain principal. It is calculated using the following formula: C.I.= P × (1+r) t - P It is calculated using the following formula: S.I.= P × R × T Simple interest is calculated on the original principal amount every time.Ĭompound interest is calculated on the accumulated sum of principal and interest. Let's understand the difference between simple interest and compound interest through the table given below: Simple Interest It is believed that compound interest is more difficult to calculate than simple interest because of some basic differences in both. Simple interest and compound interest are two ways to calculate interest on a loan amount. Now, we can also prepare a table for the above question adding the amount to be returned after the given time period. (Add a sentence here describing the given information in the question.)

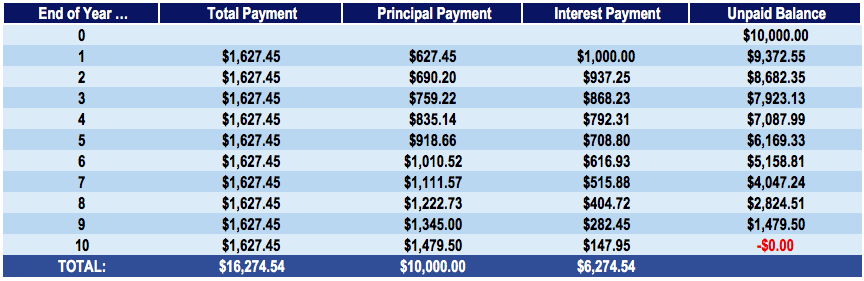

Principal Amount = $1,000, Rate of Interest = 5% = 5/100. What would the simple interest be if the amount is borrowed for 1 year? Similarly, calculate the simple interest if the amount is borrowed for 2 years, 3 years, and 10 years? Michael's father had borrowed $1,000 from the bank and the rate of interest was 5%.

#Return of principal definition plus

0 kommentar(er)

0 kommentar(er)